National Study Reports Strong Investment Results in 2019 Increased Foundations’ Intermediate-Term Returns

Data from the Council on Foundations-Commonfund Study Show Spending in Support of Mission Held Steady While Gift-Giving Declined

Contact:

William Szczecinski

Prosek Partners

646-818-9029

wszczecinski@prosek.com

New York, NY, (September 24, 2020) — Data gathered in the 2019 Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) (the “Study”) show that the year’s strong investment performance raised three- and five-year trailing returns for participating institutions. Long-term returns declined moderately, however, but only because 2009’s 20 percent-plus return dropped out of the trailing 10-year calculation.

Participating private foundations reported an average return of 17.4 percent in 2019 while participating community foundations reported an average return of 18.2 percent. Both represented a dramatic reversal of 2018’s average return of -3.5 percent for private foundations and -5.3 percent for community foundations. (All return data are reported net of fees.)

With intermediate- and long-term returns being critically important for the mission and objectives of endowed organizations, 2019’s returns were a welcomed development for foundation trustees and financial managers. Three-year returns rose to an average of 9.2 percent for private foundations compared to last year’s 6.1 percent. For community foundations, three-year returns averaged 8.9 percent versus last year’s 5.6 percent. Trailing five-year returns increased to an average of 6.6 percent for private foundations, up from 4.7 percent, while community foundations saw an increase from 3.9 percent to 6.4 percent.

Trailing 10-year returns declined when 2009’s strong return—the best annual performance since the Study’s inception in 2002—dropped out of the calculation. For 2019, private foundations reported that 10-year returns averaged 7.8 percent, down from 8.4 percent in 2018, while community foundations’ 10-year return averaged 7.7 percent compared to 8.2 percent for the same timeframe.

Participating foundations of all sizes and both types reported average investment returns of 16 percent or more in 2019, whereas all corresponding figures were negative in 2018. (In addition to being grouped by type of foundation—private or community—Study participants are categorized into size cohorts: institutions with assets over $500 million, those with assets between $101 and $500 million, and those with assets under $101 million.)

In other key data, participating foundations reported that their effective annual spending rate changed little year over year. Private foundations spent an effective annual rate of 5.4 percent in 2019 compared with 5.7 percent in 2018; for community foundations, the rate rose to 4.8 percent in 2019 versus 4.6 percent in 2018. When measured in dollars, spending by community foundations jumped sharply, with 71 percent reporting increased spending in 2019, up from 52 percent in 2018. Despite the strong investment environment in 2019, gifts and donations to community foundations were weaker. Thirty-eight percent of community foundations reported increased giving compared with 55 percent that did so in 2018. Fifty-one percent reported a decrease in gifts, up from 36 percent the previous year.

“The overall tone of intermediate- and longer-term returns reported for 2019 is very healthy for foundations and for the nation as a whole in light of the vital contributions foundations make to our society and national well-being,” said Kathleen P. Enright, President and CEO of the Council on Foundations, andMark Anson, President and CEO of Commonfund, in a joint statement.“Multi-year returns in the 8 to 9 percent range are needed to fund foundations’ spending in support of mission while also taking into account inflation and investment management costs,” Enright and Anson said, adding, “That said, the decline in gifts and donations to community foundations was not what one would have expected in 2019, which was a strong year for the economy and financial markets. Numerous studies as well as empirical evidence has shown that gift-giving is an important complement to sound investment policy when it comes to the long-term viability of mission-based organizations.”

With 265 participating foundations representing combined assets of $104.7 billion, the Study is believed to be the most comprehensive annual survey of its kind. This is the eighth year that Commonfund Institute and the Council on Foundations—two leading organizations in the field of foundation investment and governance policies and practices—have partnered to produce this research.

AVERAGE 3- AND 5-YEAR RESULTS RISE; 10-YEAR RETURNS EASE

2019 Returns Were Best Since 2009

Two-thousand nineteen’s average return of 17.4 percent for private foundations and 18.2 percent for community foundations was the best of the past 10 years and the highest since 2009 when respective returns were 20.5 percent and 22.1 percent. The strong year follows the poorest performance of the decade in 2018, when private foundations returned -3.5 percent and community foundations reported a return of -5.3 percent.

The good investment results in 2019 boosted trailing three-year returns by an average of 310 basis points annually for private foundations and 330 basis points for community foundations. Similar data for the trailing five-year period showed increases of 190 basis points for private foundations and 250 basis points for community foundations. Average annual returns over the trailing 10-year period were lower, by 60 basis points for private foundations and 50 basis points for community foundations.

Community Foundations Benefit from Public Equity Exposure

When data are analyzed across the three size cohorts into which participating foundations are segmented, community foundations reported higher 2019 returns in two size cohorts and were level with private foundations in the third. In past CCSF reports, community foundations have generally reported larger allocations to U.S. equities than private foundations, a factor that served to buoy their returns in a strong year for the public markets (e.g., S&P 500 Index was ahead 31.5 percent in 2019).

The highest single return in 2019 came from community foundations with assets under $101 million, at 18.5 percent. Like other community foundations, this cohort benefited from a relatively high allocation to U.S. equities. Additionally, among the three size cohorts, foundations with assets under $101 million reported the highest allocation to U.S. equities (43 percent versus 33 percent for all community foundations and 27 percent for all private foundations).

Returns for the largest participating foundations—those with assets over $500 million—were strong but lagged on a relative basis. These foundations had smaller allocations to U.S. equities and the largest allocation to alternative investment strategies, which, while producing good absolute returns, were not able to keep pace with exceptional returns in the public equity markets.

Foundations’ Future Return Outlook Mixed

Eighty-three percent of private foundations and 67 percent of community foundations reported having long-term return objectives in 2019. For private foundations, this was about the same as last year’s 82 percent, but for community foundations it was below last year’s 76 percent. Of those institutions with return objectives, private foundations reported an average long-term return objective of 7.0 percent, slightly below last year’s 7.3 percent. Community foundations reported a similar average long-term return objective of 7.2 percent, but a marked increase compared with 6.8 percent a year ago.

CHANGES IN THE LARGEST ASSET ALLOCATIONS

Higher for U.S. Equities, Lower for Alternative Strategies

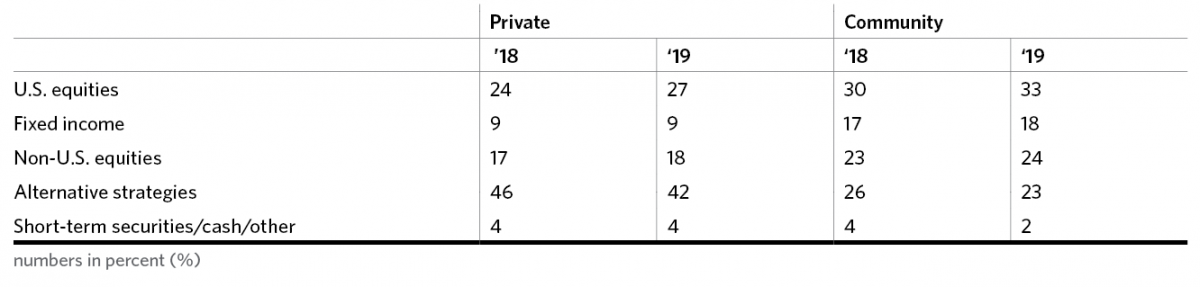

As of December 31, 2019, participating institutions’ asset allocations, and their comparable 2018 allocations, were:

While changes in asset allocation year over year were minimal for three allocations, the other two showed movement. The allocation to alternative strategies declined for foundations of both types—by four percentage points for private foundations and three for community foundations. Allocations to U.S. equities increased by three percentage points for foundations of both types. (The principal alternative strategies are private capital and marketable alternatives. The former includes U.S. and international private equity, venture capital, private credit, private real estate, and energy and natural resources. The latter includes hedge funds, absolute return, market neutral, long/short, 130/30, event-driven and derivatives.)

Year-over-year changes in allocations to the various sub-strategies within the larger alternatives category were generally minor. The exception was found with foundations’ largest allocation, which was to marketable alternative strategies. This allocation declined to 14 percent from 15 percent for private foundations and to 11 percent from 15 percent for community foundations. This allocation was also lower for foundations of both types across the three size segments. The second-largest allocation, to private equity, was unchanged at 9 percent for private foundations and 5 percent for community foundations. As has been the case in previous Studies, private foundations reported the only meaningful allocation to venture capital—an average of 8 percent versus 1 percent for community foundations.

FOUNDATIONS’ EFFECTIVE SPENDING RATE MIXED

Spending in Dollars Increases

As noted, the effective spending rate in 2019 was mixed, declining moderately for private foundations but rising for community foundations. Private foundations’ effective spending rate was 5.4 percent, down from 5.7 percent in 2018, while community foundations’ spending rate rose to 4.8 percent from 4.6 percent.

Analyzing data by size, private foundations with assets over $500 million reported an effective spending rate of 5.7 percent, up from 5.2 percent in 2018. Private foundations in the other two size cohorts reported an effective spending rate of 5.4 percent. Foundations in the largest size cohort also spent at the highest rate among all participating community foundations, 5.4 percent, a sharp increase from the previous year’s 4.7 percent. The spending rate for community foundations in the other two size cohorts showed little change compared with 2018.

Twenty-six percent of private foundations and 5 percent of community foundations reported increasing their effective spending rate in 2019 while 29 percent of private foundations and 10 percent of community foundations reported decreasing it. Both increases and decreases were modest: Increases were in the 1 percent-plus range, while decreases were under 1 percent.

Spending in dollar terms rose in 2019—most noticeably for community foundations, where 71 percent of Study respondents reported higher dollar spending, up from 52 percent in 2018. Fifty-four percent of private foundations reported spending more in dollars, one percentage point higher year over year. Thirty-seven percent of private foundations reported lower spending in dollars versus 23 percent of community foundations. This compares with 34 percent and 29 percent, respectively, in 2018.

Confronting COVID: Foundations’ Spending Rates Hold Firm in 2020

Financial markets got off to a good start in 2020, January being a strong month for equities. By mid-February, cracks began to appear and within weeks the market was in full-fledged retreat as the coronavirus spread worldwide. What was the longest bull market in history quickly turned into a bear market. Then, as quickly as the market declined, it came roaring back, eventually making history as the shortest time from a bear market low to a new record high (as measured by the S&P 500 Index).

With the coronavirus pandemic exploding into a worldwide healthcare crisis, the decision was made to delay the fielding of the 2019 CCSF, giving foundation financial staff members and trustees time to address pressing issues and begin to get their arms around the new world created by the pandemic. Once the questionnaire—which was totally focused on 2019—was ready, we took the opportunity to add a question about 2020, given an environment like no other in recent history. What changes, we asked, has your foundation made to 2020 spending in response to the virus?

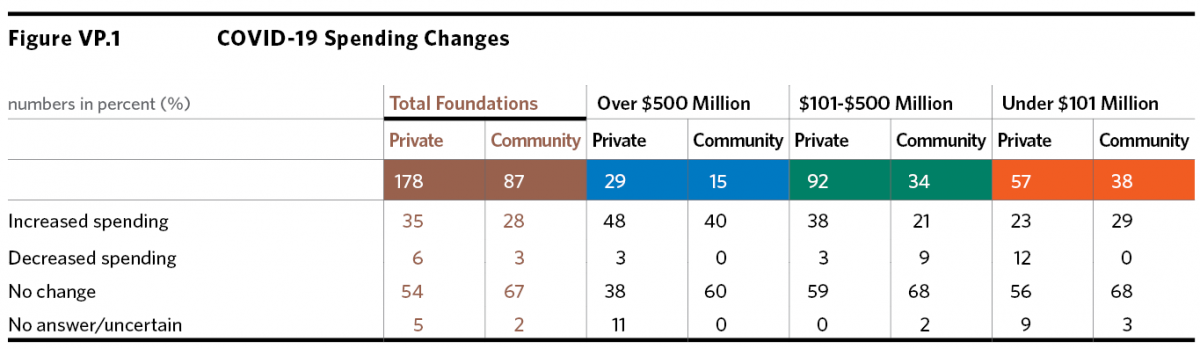

Response: Data showed that most foundations held their effective spending rate steady and those reporting increases were well in excess of those that decreased their spending rate.

Fifty-four percent of private foundations and 67 percent of community foundations said they made no change to their spending rate. Thirty-five percent of private foundations and 28 percent of community foundations reported increasing spending, while only 6 percent of private foundations and 3 percent of community foundations said they lowered it. (Five percent of private foundations and 2 percent of community foundations gave no answer or were uncertain.)

As the accompanying table shows, 48 percent of private foundations with assets over $500 million reported increasing their spending rate, while just 3 percent decreased it. In the same size cohort, 40 percent of community foundations said they increased their rate, 60 percent held it unchanged and none reduced it. The majority of respondents in the other two size cohorts reported no change.

GIFTS AND DONATIONS TO COMMUNITY FOUNDATIONS DECLINE

Larger Foundations Attract Significantly Greater Giving

Gifts and donations to community foundations declined in 2019 compared with 2018 as 38 percent of these foundations reported an increase—down from 55 percent in 2018—while 51 percent reported a decrease versus 36 percent a year ago. Community foundations with assets over $500 million separated themselves from the other two size cohorts, however, as 53 percent reported an increase—up from 30 percent last year—and just 13 percent reported a decrease compared with last year’s 40 percent.

###

About the Council on Foundations

An active philanthropic network, the Council on Foundations (www.cof.org), founded in 1949, is a nonprofit leadership association of grantmaking foundations and corporations. The Council on Foundations fosters an environment where philanthropy can thrive and cultivates a community of diverse and skilled philanthropic professionals and organizations who lead with integrity, serve as ethical stewards and advocate for progress. We imagine a world where philanthropy is a trusted partner in advancing the greater good.

About Commonfund

Commonfund was founded in 1971 as an independent asset management firm focused on not-for-profit institutions. Today, we are one of North America’s leading investment firms, managing $23.8 billion in assets for 1,381 institutional clients, including educational endowments, foundations and philanthropic organizations, hospitals and healthcare organizations and pension plans. Our only business is investment management, and we are active in all sectors of the global capital markets, both public and private.

About Commonfund Institute

Commonfund Institute houses the education and research activities of Commonfund and provides the entire community of long-term investors with investment information and professional development programs. Commonfund Institute is dedicated to the advancement of investment knowledge and the promotion of best practices in financial management. In addition to teaming with the Council on Foundations to produce the CCSF, Commonfund also produces the Commonfund Benchmarks Study® series of research reports. Commonfund Institute also provides a wide variety of resources, including conferences, seminars and roundtables on topics such as endowments and treasury management; proprietary and third-party research and publications, including the Commonfund Higher Education Price Index® (HEPI); and events such as the Investment Stewardship Academy and the annual Commonfund Forum.